Staying Afloat with an Underwater Mortgage

For those with underwater mortgages, it is nearly impossible to stay afloat in the turbulent seas of the housing market.

For those with underwater mortgages, it is nearly impossible to stay afloat in the turbulent seas of the housing market.

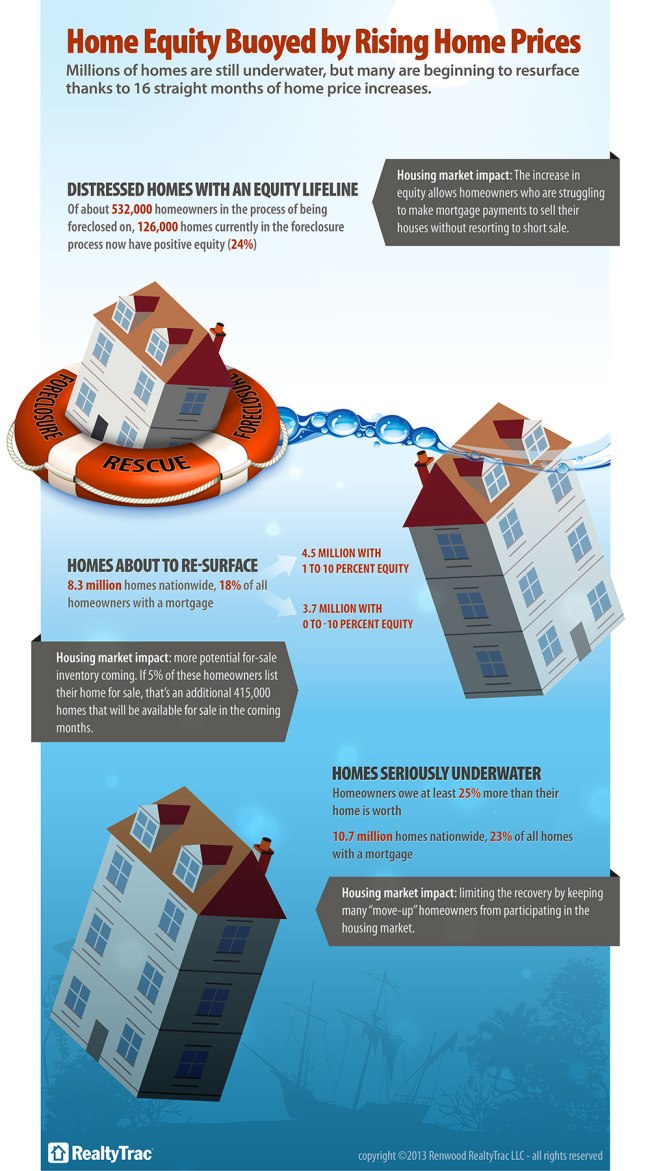

The U.S. Home Equity & Underwater Report for September 2013 states that 10.7 million residential homeowners nationwide owe at least 25% or more on their mortgages than their properties are appraised for. Of course this percentile is discouraging and feels unfair to homebuyers.

However, some homebuyers can take a sigh of relief. According to a recent study by RealtyTrac, the nation’s leading source for comprehensive housing data, 8.3 million homeowners who were previously underwater are now on the verge of positive equity.

So what are the real world implications for this study? These 8.3 million homeowners are on track to have enough equity to sell their homes within the next 15 months WITHOUT resorting to a short sale!

“Steadily rising home prices are lifting all boats in this housing market and should spill over into more inventory of homes for sale in the coming months,” said Daren Blomquist, VP at RealtyTrac. “The 8.3 million homeowners on the fence with little or no equity are on track to regain enough equity to sell before 2015

if home prices continue to increase at the rate of 1.33 percent per month that

they have since bottoming out in March 2012.”

In short, the effects of rising home prices and homeowners with resurfacing equity are both encouraging trends in the housing market. With more positive equity, homebuyers have yet another alternative to foreclosure and are able to reinvest their money as they please.

All things considered, this new trend is beneficial to the real estate market and to the homeowners who have struggled so long with underwater mortgages, giving those who feel as though they are drowning, a breath of much needed fresh air.

If you are currently struggling with your mortgage payments, we are here to help, please call us for a free 30 minute consultation to determine if you would be a good candidate for a modification and/or bankruptcy. Our associates can be reached at (213) 986-4323.

Written by: Katie Morrow, Legal Assistant, Vokshori Law Group